Used EV Prices Plummet After Tax Credit Expiry, But Teslas Remain Resilient

- Used Tesla prices have increased after the end of the federal tax credit.

- Non-Tesla used EVs, on the other hand, are seeing their prices drop.

- This points to more demand and loyalty toward Teslas, while other brands relied more on the federal tax credit to drive sales.

Only four months after the end of the federal clean vehicle credit for electric vehicles, the EV market is already beginning to shift toward more organic consumer demand. One of those signs is emerging in the used EV market, where the loss of incentives has sent prices of some EVs falling.

Teslas, though, are bucking that trend, showing that there’s still strong demand for secondhand electric cars even without up to $4,000 on the hood. It’s yet another sign that Americans are more than willing to get on the EV train for the right price.

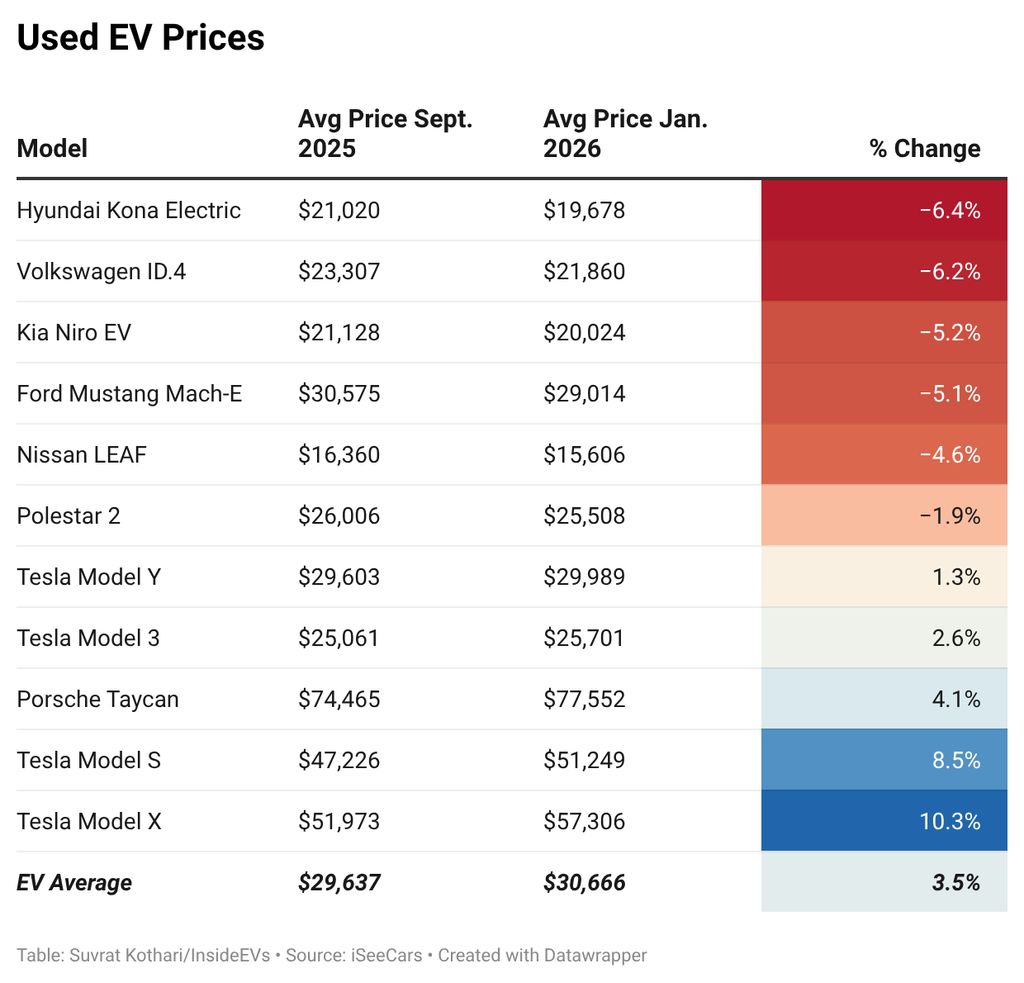

According to a new study by car research firm iSeeCars, the average price of used Teslas increased 4.3% to $31,329 after the end of the tax credits. Meanwhile, the average price of the rest of the used EV market fell 3.6% to $23,738. The firm analyzed over 1.7 million one- to five-year-old used cars and millions of new cars sold between September 2025 and January 2026.

“When looking at new and used EV price shifts, it seems clear manufacturers and dealers are trying to offset the loss of the EV credits with lower prices on mainstream models,” iSeeCars Executive Analyst Karl Brauer said in a statement. “But Tesla pricing has proven resilient, rising while nearly every other electric vehicle price has fallen since the EV credits went away.”

Photo by: Suvrat Kothari

Used EVs that have seen the largest price drop after the end of the tax credit include the Hyundai Kona Electric (-6.4%), Volkswagen ID.4 (-6.2%), Kia Niro EV (-5.2%), Ford Mustang Mach-E (-5.1%) and the Nissan Leaf (-4.6%).

One potential reason for the divide between Tesla and the rest: For many buyers, owning a used Tesla is an easier and more reliable experience than owning another model, which may require navigating fragmented charging apps or settling for subpar range and software. Teslas, on the other hand, have historically offered the best in-vehicle software and seamless plug-and-charge access to over 36,000 Supercharger ports nationwide. While newer EVs have substantially improved in those areas, it will be years before they enter the used market.

Since Teslas still account for the vast majority of the used EV market, the average price of one- to five-year-old used EVs, including Tesla and non-Tesla vehicles, actually increased 3.5% to $30,666 since Septmber. At the same time, the average price of used gas cars dropped 2.0% to $31,249. This suggests that the used EV market is getting stronger, but mainly on the back of Teslas.

There’s another sign that the used EV market is doing fairly well even during this turbulent time for electrification. The days supply for used EVs in January was still below the days supply for used gas vehicles, according to Cox Automotive. New EVs, on the other hand, were much slower to move off of dealer lots than their non-electric counterparts.

At the same time, the electric share of the lightly used car market dropped from 3.5% to 2.8% between September and January, iSeeCars says, mainly due to the loss of the $4,000 used EV tax credit. This mirrors the pull-forward effect we’ve witnessed in the new EV market too. EV market share exploded in the third quarter as people rushed to claim the tax credit, then dropped precipitously in the months following.

There’s one wild card on the way, too. The tax credit-fueled EV leasing boom means hundreds of thousands of lightly used electric models will flood the market in the next couple of years. As the new EV market stagnates for the time being, the used sector may be the one to watch—especially if you want a great deal.

Contact the author: suvrat.kothari@insideevs.com