Rise in southern States’ share in devolution of funds provides no relief to Tamil Nadu

People watch the Union Budget 2026-27 being presented by Union Finance Minsiter Nirmala Sitharaman on February 1, 2026. Veteran experts in public finances say Tamil Nadu has got virtually nothing extra.

| Photo Credit: The Hindu

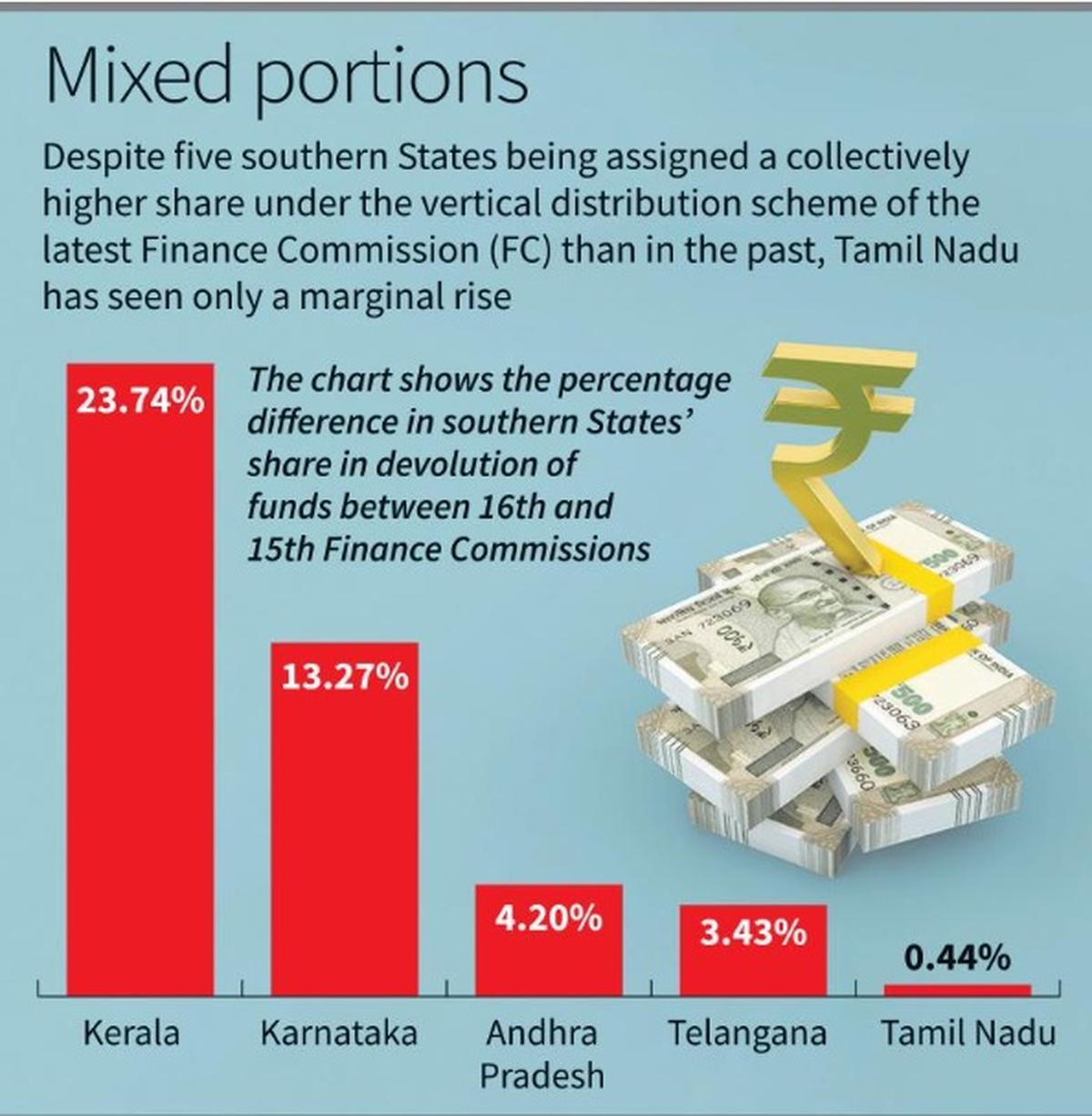

Despite five southern States being assigned a collectively higher share under the vertical distribution scheme of the 16th Finance Commission (FC) than in the past, Tamil Nadu’s share has seen only a marginal rise.

The share of Tamil Nadu, which was 4.079% in the 15th FC, rose to 4.097% now, accounting for a rate of increase of 0.44%. This was followed by Telangana with a rise of 3.43% and Andhra Pradesh with 4.2%. Only Karnataka and Kerala have witnessed a double-digit rate of increase — 13.27% and 23.74%. At the all-India level, Kerala’s degree of rise is only next to Haryana’s 24.52%, while the third slot goes to Karnataka.

‘Virtually nothing’

Veteran experts in public finances say Tamil Nadu has got virtually nothing extra. “Yet again, unfair treatment” is the refrain of the analysts. One of the experts contends that the 16th FC included contribution to Gross Domestic Product (GDP) as one of the criteria for horizontal devolution. But for this category, Tamil Nadu’s share may have gone down. The criterion of tax and fiscal efforts has been removed, while the weights assigned to the criteria of area, demographic performance and per-capita Gross State Domestic Product (GSDP). Only the criterion of population has seen an increase in weight from 15% to 17.5%, which, however, does not benefit the southern States including Tamil Nadu and Kerala.

K.R. Shanmugam, former Director of the Madras School of Economics, says the rise in the vertical devolution for the south seems to have been achieved by decreasing the share of six northern States such as Uttar Pradesh, Madhya Pradesh and Bihar, besides West Bengal. The combined share of the seven States, which stood at 51.20%, has been brought down to 49.93%.

Pointing out only relief and temporary restoration works are covered under disaster response fund schemes, a veteran policymaker suggests that the Union government follows the example of the Tamil Nadu government, which had created in the aftermath of the December 2015 floods in Chennai and surrounding areas, a project preparation fund of ₹100 crore for the formulation of projects to be posed to funding agencies. Such a fund would be useful to the States that experience natural disasters frequently.

The 16th FC has dealt elaborately with the subject of subsidies, an area where the south has been a trendsetter. “At ₹78,453 crore, Tamil Nadu had the highest absolute level of subsidy in 2023‑24, followed by Karnataka, Andhra Pradesh and Telangana at ₹70,149 crore, ₹63,951 crore and ₹62,847 crore respectively,” the panel records. Pointing out that the absolute subsidy levels are “somewhat misleading” given the State’s size, the Commission names Telangana as one of the States wherein subsidy levels, as a proportion of respective GSDP, exceeded 5% during 2024-26, and Andhra Pradesh having the subsidy level standing between 3% and 5%.

As for channelising subsidies to the eligible beneficiaries, the FC report refers to measures taken by Andhra Pradesh, Telangana and Tamil Nadu governments. It acknowledges that by employing information technology (IT) enabled data analysis on integrated databases, such States have been able to de-duplicate and streamline beneficiary listing, leading to substantial savings.

Even though the southern States had taken a similar stand on many issues, they differed among themselves over revenue deficit grants, meant for bridging the revenue gap. While Karnataka expressed scepticism, Andhra Pradesh, Kerala and Tamil Nadu wanted the continuation of these grants. However, the 16th FC’s recommendation was against the grants.

16th Finance Commission report tabled, states’ tax share retained at 41%

The Centre’s decision to retain States’ share in the common pool of taxes at 41% for 2026–31 has sparked criticism from opposition leaders. Finance Minister Nirmala Sitharaman tabled the Sixteenth Finance Commission report in the Lok Sabha on February 1, 2026, setting the framework for tax devolution between the Centre and States. Several States, including Karnataka and Kerala, had sought a higher 50% share, citing rising fiscal responsibilities.

| Video Credit:

The Hindu

Published – February 03, 2026 12:24 am IST