Stock markets trade higher in early trade tracking rally in Asian peers

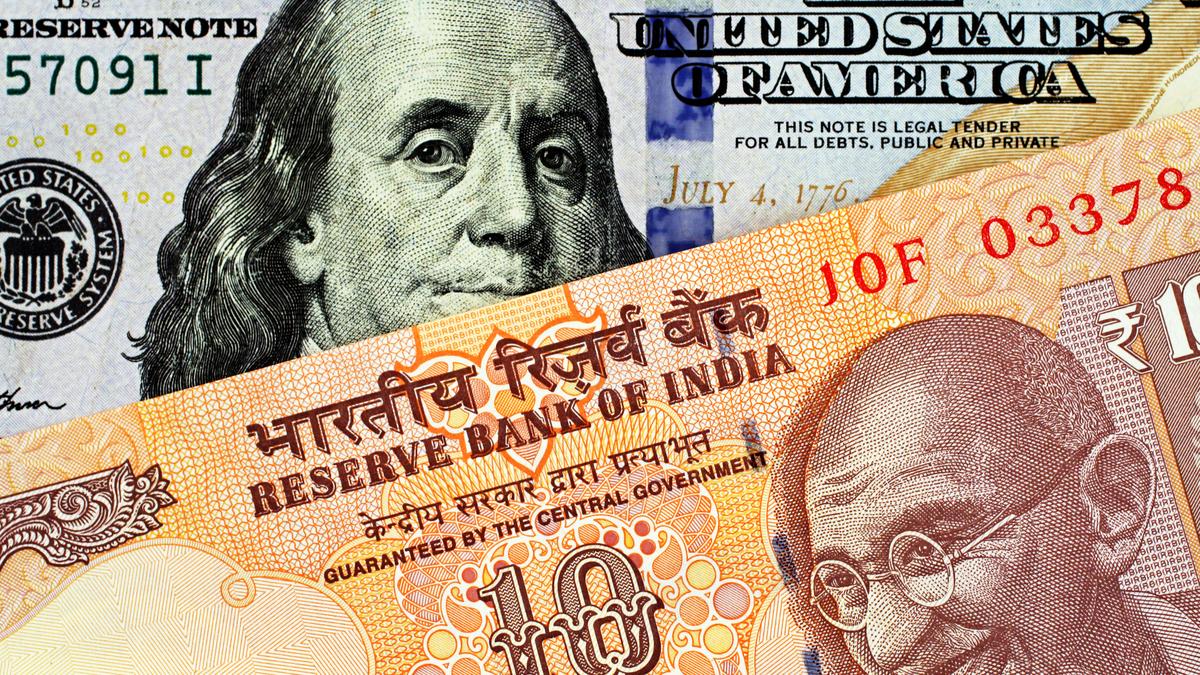

Equity benchmark indices Sensex and Nifty opened on a positive note on Monday (February 9, 2026) amid foreign fund inflows, a rally in Asian markets and optimism following a fresh trade agreement between India and the U.S.

The 30-share BSE Sensex climbed 441.77 points, or 0.53%, to 84,022.17 in the morning trade. The 50-share NSE Nifty rose 129 points, or 0.50%, to 25,822.70.

Among the 30-share Sensex constituents, State Bank of India, Titan, Eternal, Kotak Mahindra Bank, Bharat Electronics Ltd, Tata Steel, Sun Pharmaceuticals, Larsen & Toubro, Adani Ports, IndiGo, Reliance Industries and Bharti Airtel were the gainers.

On the other hand, PowerGrid, ITC, Hindustan Unilever, Bajaj Finance, Trent, Infosys, ICICI Bank, Axis Bank, NTPC, Tech Mahindra, Tata Consultancy Services, HDFC Bank were among the laggards.

Foreign institutional investors bought equities worth ₹1,950.77 crore on Friday (February 6, 2026), according to exchange data.

“A big positive for the market is that FIIs who were sustained sellers in the market have bought in the cash market in three out of the last four trading days. The fact that the derivatives market continues to be heavily net short might impart resilience to the market, on expectations of short covering,” V.K. Vijayakumar, chief investment strategist, Geojit Investments Ltd, said.

He added that the recent ‘Anthropic shock’ will continue to impact sentiments in the IT sector. On the contrary, banking stocks are likely to gather strength on news of improving credit growth, which will have positive fall out for GDP growth and corporate earnings in FY27.

In Asian markets, Japan’s Nikkei 225, South Korea’s Kospi, Shanghai’s SSE Composite index and Hong Kong’s Hang Seng index trading higher.

Devarsh Vakil, head of prime research, HDFC Securities said Japan’s ruling Liberal Democratic Party, led by Sanae Takaichi secured a decisive victory pushing the Nikkei to record highs.

He noted that Indian equities stand to gain as Japanese capital pivots away from China under Takaichi’s “Economic Security” policy, with billions in FDI expected to flow into Indian infrastructure and technology sectors, he said.

Mr. Vakil further said India and the U.S. on Saturday (February 7, 2026) reached an interim trade agreement ending their ten-month tariff war, with Washington reducing tariffs on Indian goods from 50% to 18%.

India successfully protected sensitive agricultural sectors like dairy while committing to purchase $500 billion in U.S. goods over five years, focusing on energy, aircraft, and defence technology.

The deal strategically integrates India into the U.S.-led “Pax Silica” initiative for critical minerals and AI supply chains, positioning India as a counterweight to China in the Indo-Pacific, he added.

U.S. markets ended more than 2% higher on Friday (February 6, 2026).

Brent crude, the global oil benchmark, declined 0.94%, to $67.41 per barrel.

On Friday (February 6, 2026), the 30-share BSE Sensex advanced 266.47 points to settle at 83,580.40, while the NSE Nifty climbed 50.90 points to end at 25,693.70.

Published – February 09, 2026 10:57 am IST