SBI Q3 FY26 net increased 24.5% to ₹21,028 crore

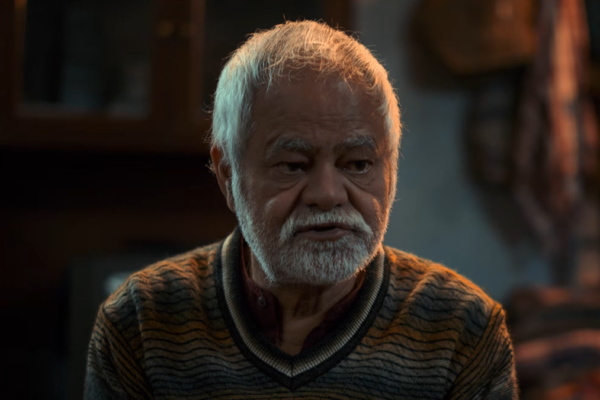

Image used for representational purposes only.

| Photo Credit: The Hindu

State Bank of India (SBI) standalone profit after tax increased 24.5% to ₹21,028 crore on an increase in net interest income (NII) in third quarter fiscal 2026 as against ₹16,891.44 crore in the year ago period.

Net Interest Income (NII) increased by 9.04% in Q3FY26 on a year-on-year basis. The net interest margin for the bank dipped marginally to 3.12% in the reporting quarter from 3.15% in the year-ago period.

Gross advances increased 15.17% to 46.8 lakh crore, and gross deposits increased at a slower 9.02% to ₹57 lakh crore in the quarter ended December 2026. On the asset quality front, the bank’s Gross Non Performing Asset (GNPA) dipped 12.3% to ₹73637 crore, and Net NPA dipped 15.74% to ₹18012 crore in the reporting quarter.

Speaking on the performance, the Chairperson C.S. Setty said, “The deposit’s growth remained healthy with current account growth in double digits despite competitive market environment.”

“Deposits at our foreign offices have grown well at 8.32% year-on-year basis. Credit growth has remained strong, and there has been a robust demand for credit across all the segments…Retail, Agriculture, MSME and Corporate have crossed ₹26 trillion with year-on-year growth of 16.51%. All the components have witnessed double-digit growth. The domestic credit deposit ratio was at 72.98% at the end of Q3 of 526, an improvement of 404 basis points year-on-year. We have enough headroom to address future credit growth requirements both in terms of capital and liquidity,” he added.

While delineating the downside risks to be geopolitical tensions, global trade uncertainties, financial market volatility and commodity price fluctuations, Mr. Setty further said that the increasing role of capital markets in the financial savings for households was increasing. The Chairperson said this a week after he said that deposit holders were not taxed on par with equity holders a week ago.

Emphasising this, he said that banks had to look to restructure their balance sheets and would have to start accessing the bond markets to mobilise funds as deposits were reducing as a share of household savings.

“The banks will be able to access the bonds, if not lower than the deposits, at least equivalent to the deposit cost. That will give the facility and flexibility for the banks to structure their balance sheets,” said Mr. Setty, adding that any such discussions will have to factor into the conversation about banking for “Viksit Banking”. The comment becomes important as the finance minister had announced the formation of a High-Level Committee on Banking for Viksit Bharat.

Mr. Setty also informed that SBI mutual fund would hit the public market for the initial public offer before September 2026.

Published – February 07, 2026 02:38 pm IST