How GM Plans To Make Every Part Of Its EV Batteries In North America

- General Motors has been signing a string of raw material supply deals for EV batteries over the past few years.

- The vast majority of those supply deals include companies with North American operations.

- Multiple suppliers in Canada are central to GM’s plans to continue making EV batteries cheaper.

General Motors last year gave a clear signal that it wants to localize battery manufacturing for its electric vehicles in a serious way. The automaker already operates two U.S. battery gigafactories with Korean giant LG Energy Solution already. But now, it’s pushing even further to untangle itself from China-dominated battery supply chains, seeking to localize the whole chain.

Companies with a tighter grip over their battery materials also get a bigger say in how much their EVs will end up costing, which is part of the reason why Chinese EVs are so competitively priced. GM is headed in that same direction, pushing to establish a North American supply chain to make EVs affordable and less vulnerable to geopolitics.

In a recent episode of the Core Memory Podcast, GM Battery Engineer and Business Planning Manager Andy Oury offered a deeper look at how the company plans to rein in its battery supply chain and still drive down costs without sacrificing range or performance in future EVs.

“As we get close to the end of this decade, the level of battery manufacturing independence that we have will be almost unrecognizable from today,” Oury said.

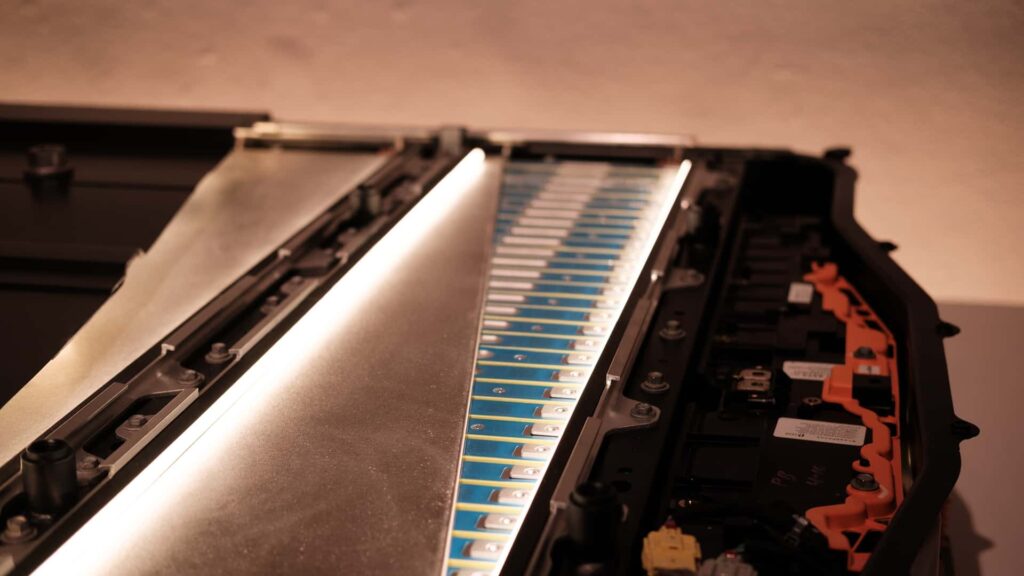

GMC Hummer EV’s Ultium battery pack.

That ambition is already showing up in a string of sourcing deals GM has struck over the past few years, aimed at securing supplies of the raw materials that go into a battery cell from within North America. That includes lithium, as well as cathode active materials (CAM) such as nickel, cobalt, manganese and aluminum. Many of these agreements were signed in the wake of the Biden-era Inflation Reduction Act, which imposed strict sourcing requirements for EV tax credits.

GM currently relies on nickel manganese cobalt aluminum (NMCA) batteries in a pouch format across its EV lineup, from the $35,000 Chevy Equinox EV all the way up to the $100,000 GMC Hummer EV. But the automaker is also preparing to introduce a new lithium manganese-rich (LMR) chemistry, which reduces the amount of expensive nickel and cobalt and increases the proportion of manganese. GM says this combination will deliver a battery that costs roughly the same as low-cost lithium iron phosphate (LFP) packs, while offering a driving range closer to traditional NMC batteries.

The automaker plans to source manganese from the U.S. arm of Australian miner Element 25. While the manganese itself will be mined in Australia, it will be processed at Element 25’s plant in Louisiana, according to the company. When the deal was announced in 2023, GM said the agreement covered 32,500 metric tons of manganese sulfate annually, enough to power about 1 million EVs in North America. With EV demand expected to be wobbly this year in a post-tax credit environment, it’s unclear whether there are any changes to the terms of that deal.

LMR batteries still require nickel, just in much smaller amounts. For that, GM has partnered with Brazilian mining giant Vale, which is expected to begin supplying nickel sourced from its Canadian operations starting in 2026. Under the original agreement, Vale planned to build a dedicated facility in Quebec, but the second phase of that project was paused last year, according to Mining.com, due to a projected cooling of EV demand in the U.S. Vale has said it still plans to begin nickel production in 2026 and can rely on several existing Canadian plants in the meantime.

GM has also moved to localize the anode side of the battery, which is the part of the cell that stores energy during the charging cycle. Last year, it signed a multibillion-dollar deal with Norwegian battery materials company Vianode to supply synthetic graphite, a key material used in the anode. Vianode said it plans to begin shipping high-performance graphite from its large-scale plant in Ontario starting in 2027.

And finally, there’s lithium. GM is working with Lithium Americas to source battery-grade lithium carbonate from the Thacker Pass mine in Nevada. The automaker has invested $625 million in the project, securing a 38% stake. Lithium Americas owns the remaining share and operates the mine.

GM Forward Event 2025, LMR Batteries

Photo by: Patrick George

“The battery is the most expensive part of an EV. The cells are the most expensive part of the battery pack. The cathode is the most expensive part of the cell,” Oury said. “With our LFP and LMR announcements, we’re directly attacking the most expensive part of the cell,” he added, referring to GM’s push to cut costs right at the source.

The automaker uses low-cost LFP cells on the new Chevy Bolt and plans to do the same on a future trim of the Silverado EV. And from 2028, it will start using prismatic LMR cells on its full-size trucks, which it says will deliver more than 400 miles of range at a lower cost.

“This is not about making people buy electric vehicles. It’s about making electric vehicles that people want to buy,” he added.

Contact the author: suvrat.kothari@insideevs.com